Current Market Conditions Impact Milk Prices

Beginning last month, we began to see some interesting dynamics that are affecting market conditions and driving milk prices down. I wanted to share what I am seeing in the market, how milk prices will be impacted, and when we hope to see the market stabilize and being to improve.

First, a fire at an AMPI processing cheese plant in Portage, WI, is impacting the market more than anyone expected. While having one cheese plant go offline may not seem significant, the industry does not have a lot of reserve capacity and that affects everyone in making processed cheese and using barrel cheese. We’re seeing a huge amount of backlog of barrel cheese in the marketplace creating big price disruptions. Barrel cheese inventory will have to be used before we see supplies return to normal levels.

Additionally, in the beginning of 2022, our larger key customers ordered large quantities of cheese curds for breading in anticipation of supply issues due to the pandemic. There is now an over-amount of breaded cheese curds in inventory than the marketplace can consume. This is similar to what happened with toilet paper during the beginning of the pandemic—people overbought and now have toilet paper stockpiled that will need to be consumed before they have a need to buy more. While the retail side of cheese curd sales is doing fairly well and holding steady, a large percentage of cheese curds sold in bulk are being impacted by this earlier run on the curd market.

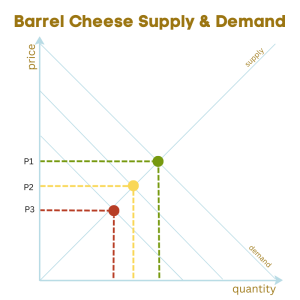

P1 denotes regular market pricing. When AMPI’s fire occurred, they stopped purchasing barrels which shifted demand for barrel cheese in the marketplace downward (P2). Impacting the market further is the decreased demand for cheese curds leading to more barrel cheese, further adding to an over-supply (P3).

Compounding matters, milk supply is plentiful throughout the country and there is more milk than the industry can absorb. Normally, we would sell milk during times such as this. This option is currently not available to unless we choose to take a deep discount of 70-80% of the value of the milk. Delay in adjusting the federal milk order pricing gives the wrong signal on what Class 3 pricing should be compared to the actual cost associated with manufacturing cheese.

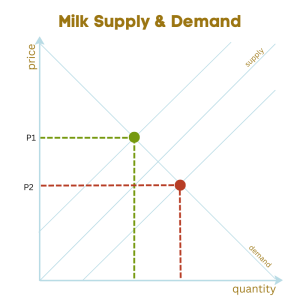

P1 denotes regular market pricing. Milk is in excess supply and as a result milk prices are being driven down (P2).

Micro-economic effects and economic conditions on a world-scale may cause a slowdown in the economy that could lead to less buying of our product. As economies slow down, we see less dollars available to purchase dairy products.

Each of these factors is outside of our direct control. What we are experiencing is basic economics and the above supply and demand charts illustrate current market conditions. All factors combine, creating a perfect storm of increased barrel cheese inventories and lower milk prices for the next several months.

We expect these influences to negatively impact milk prices until April or May, at which time we typically see an increased demand for cheese curds. We hope that will lead to more favorable conditions and a recovery in pricing. As demand for cheese curds increases, we will stop making barrels. Barring a major economic downturn, we should begin to see a shortage in fresh barrel cheese and as barrel cheese is consumed in the marketplace the pricing dynamics will shift in our favor. Once AMPI is again online and consuming barrel cheese, that will shift prices higher yet again.